The Malaysian Anti-Corruption Commission (MACC) conducted simultaneous raids on over 24 separate premises in a major strike against foreign investment fraudsters working in Malaysia. Over 81 suspects have been arrested, including British, Philippine, New Zealand and South African citizens, in what has been one of the country’s largest crack downs on share market and securities fraud.

The raids targeted call centres run by scammers from several nationalities, various registered offices of Malaysian companies and the private homes of key suspects connected to a major international syndicate.

The syndicate is allegedly involved in scamming over AUD $1 billion from Australian investors in fake share market deals.

“This criminal group [has left] a path of destruction and financial ruin to the Australian victims”, said Mr Ken Gamble, IFW’s executive chairman and cybercrime specialist, who was present during the raids yesterday.

IFW Global represents 20 victims who were allegedly scammed by this syndicate with total losses in the vicinity of AUD 63,000,000 (MYR 200,000,000).

How the international scam syndicate worked

The alleged frauds against Australian victims involved purported investment brokers soliciting investments into IPOs and other securities. The scammers placed adverts on Facebook, published websites and educational material to attract investors to make an enquiry about how to invest in major IPOs and purchase shares in multinational companies.

The alleged fraudsters operated dozens of professional websites and self-published major international headline articles to boost the reputation of their fake virtual companies, which often would not last more than three months before closing and re-emerging under a different name.

Mr Gamble said, “These alleged fraudsters claimed to be working for major financial advisory firms in Southeast Asian countries such as Hong Kong, Japan, and Korea, but they were sitting in secret offices in Malaysia selling non-existent shares using high pressure sales techniques and cleverly prepared sales scripts to scam investors”.

The syndicate has been allegedly operating for 15 years in Malaysia with some degree of impunity due to alleged protection by a local Malaysian crime group with significant connections to current and past high ranking police officials.

The group is accused of laundering billions of dollars into Malaysia from hundreds of different Hong Kong bank accounts. Almost all the victims who were lured into paying for shares or investing into IPOs, were instructed to wire their money into purported “transfer agents” and “escrow accounts” in Hong Kong, when in fact the accounts were controlled by a sophisticated Chinese money laundering syndicate using hundreds of “money mules” from Mainland China.

“This is one of the most sophisticated and well-established scam syndicates we have seen in many years”, said Mr Gamble.

February 21: cracking down on the boiler room scam

At 4pm local time on February 21, over 130 MACC and immigration officers, led by an elite Special Tactical Force (PASTAK) from the Malaysian immigration department, stormed the call centres in Kuala Lumpur and Penang, arresting suspects and searching for evidence.

The operation followed months of covert surveillance and intelligence gathering by the MACC after being tipped off by IFW about the syndicate’s operations in Malaysia.

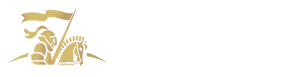

The MACC strike was well planned and executed with more than 24 premises raided and large volumes of evidence seized, including scripts, documents, client lists, handsets, computers, laptops, and mobile telephones. Several large safes were also seized and cracked open by authorities to reveal cash and valuables.

During the raid at a business centre in Damansara, Selangor, a 36-year-old man from New Zealand was injured after jumping three storeys while striving to evade authorities. In a last-ditch attempt to avoid arrest, he leaped from the 14th floor onto a water tank on the 11th floor, breaking his hip bone and hand in the process.

Hafisham Mohd Noor, assistant operations director at the Selangor Fire and Rescue Department, has confirmed that the man’s injuries are being treated by the Red Crescent team.

The MACC chief commissioner has since announced that local enforcement officers may have been bribed to turn a blind eye.

At a press conference at the MACC headquarters, chief commissioner Tan Sri Azam Baki stated that certain enforcement officers in Putrajaya may have been bribed to permit operations to carry on without interference and protect the boiler room scam.

During the raids, MACC personnel discovered multiple names within documents stored by the scam syndicate. However, further investigations are required to determine the exact nature of the suspected protection.

Azam also reported that police did not partake in this joint operation because the scam’s offences were committed under the MACC Act and Immigration Act.

February 28: another raid actioned in the centre of Kuala Lumpur

Just one week on from the first series of raids, the MACC cracked down on yet another alleged operation centre for this boiler room scam syndicate.

Only 1km from the Kuala Lumpur Police Headquarters, the premises was in the process of being set up as a call centre that could launder money via cryptocurrency.

Approximately 200 computers, RM5,000 in cash, several smartphones and employment contracts prepared for ‘call centre’ workers were discovered when the MACC stormed the site.

However, the task force detained a 41-year-old British web designer at Kuala Lumpur International Airport 2 on the same day. Investigators suspect that the man has been hired to develop fake investment websites for the syndicate.

March 3: several financial institutions raided in Kuala Lumpur

Led by deputy commissioner Datuk Mohamad Zamri Zainul Abidin, the MACC’s Anti-Money Laundering (AML) task force has raided multiple banks and company registrar premises believed to have acted as ‘middlemen’ for the international scam syndicate.

Access to these financial institutions may have enabled the syndicate to establish companies and bank accounts in Malaysia, making it the perfect base for the scam.

According to MACC chief commissioner, Tan Sri Azam Baki, the task force collaborated with the Malaysian Communication and Multimedia Commission (MCMC), Companies Commission of Malaysia, Tenaga Nasional Berhad, Immigration Department and the Inland Revenue Board.

Fake business names behind the scam

IFW Global has confirmed that the following business names were used as part of the scam.

Genesis Capital Group Limited – Current Virtual Company – April 2023

Alias: Max SCHAFFER

email: [email protected]

Purported Address: Level 43, AIA Tower, 183 Electrical Road, North Point Hong Kong

+852 5808 2853

Monarch Broker

Purported to be in Hong Kong, Malaysia and New York

AS Colins Continental

Purported to be in Taipei, Taiwan

Ascendant Asset Management

Purported to be in Kowloon, Hong Kong

JK Marshall Mercantile

Purported to be in Seoul, South Korea

Inter Berner Dubois

Purported address of Tokyo, Japan

White Oak Capital Asia

Purported to be in New York and Hong Kong

Agard Union Trading

Purported address of Seoul, Korea

See also our scam alert article

Lincoln Management Group

www.lincolnmanagementgroup.com

Purported address of Tokyo, Japan

Charrington Pacific Group

Purported to be in Tokyo, Japan & Kuala Lumpur, Malaysia

Tochigi Ontario Holdings

Purported to be in Tokyo, Japan & Kuala Lumpur, Malaysia

Cullman Mutual Capital

Purported to be in Tokyo, Japan

Kingsman Investment Limited

Purported to be in Hong Kong

KML Investments

Purported to be in Chuo-Ku, Tokyo

Julius Cohen Securities

Purported to be in Tokyo, Japan

Aspen Asset Management AG

Purported to be in Seoul, South Korea

Suncap Advisors (Sun Capital Advisors)

Purported to be in Taipei, Taiwan

S Venture Capital Advisors

Purported to be in Adelaide, Australia

Chiba Taiko Partners

Purported to be in Osaka, Japan

Fujisawa Yoyama Group

Purported to be in Tokyo, Japan

Garner Tongyeong International

Purported to be in Seoul, Korea

For information about this story, please contact [email protected]

Learn more about boiler scam investigations

If you have fallen victim to a similar scam, discover more information on IFW Global’s serious and organised fraud investigation and asset recovery services.

A global leader in financial crime investigation, we have the skilled specialists, exclusive resources and cross-border connections to collect intelligence, action advanced surveillance, hunt down criminals and help to recover your losses.

Philippines National Police

Philippines National Police  Californian Association of Licensed Investigators

Californian Association of Licensed Investigators  NSW Police Force

NSW Police Force  Philippine Securities and Exchange Commission

Philippine Securities and Exchange Commission